south st paul mn sales tax rate

Did South Dakota v. Sales Tax State Local Sales Tax on Food.

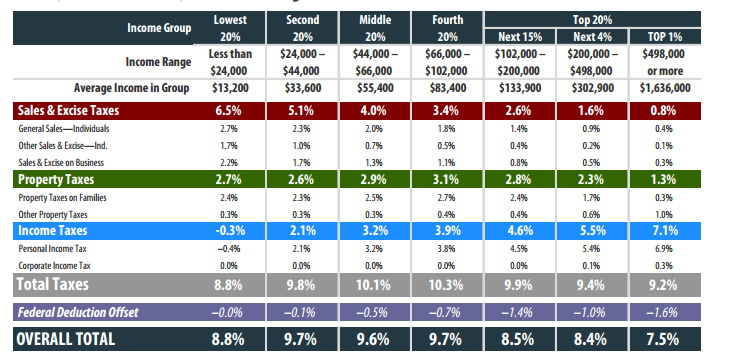

Minnesota Ranks 9th Highest In State And Local Taxes American Experiment

Property Tax Data and Statistics.

. South Saint Paul MN - Peer Comparisons by Rank and Percentile. Paul is 7625 percent. Sales tax is due on most purchases or acquisitions of motor vehicles.

The results do not include special local taxessuch as admissions entertainment liquor lodging and restaurant taxesthat may also apply. Sales and Corporate Tax Statistics. Individual Income Tax Statistics.

The minimum combined 2021 sales tax rate for St Bonifacius Minnesota is. 31 rows Plymouth MN Sales Tax Rate. South Metro Fire Department.

247 4th Avenue S South Saint Paul MN 55075. Learn all about South St. Town Square TV Council Meetings QuickLinksaspx.

9800 of gross income. Minnesota Historical Tax Rates. The south st paul sales tax rate is.

The US average is 73. Get the latest property info at RealtyTrac. The 7875 sales tax rate in Saint Paul consists of 6875 Minnesota state sales tax 05 Saint Paul tax and 05 Special tax.

Ft 4 beds 4 baths. Paul MN 55075 Phone. For more information see Local Sales Tax Information.

Paul MN 55075 651 455-6500. 6875 Transit Improvement Tax. It is based on the total purchase price or fair market value of the vehicle whichever is higher.

The County sales tax rate is. It contains 6 bedrooms and 3 bathrooms. There is no applicable county tax.

Anthony city Stearns County MN. Paul has seen the job market increase by 18 over the last year. The US average is 46.

Corporate Income Tax Personal Income Tax Unemployment Compensation Sales. This is the total of state county and city sales tax rates. Paul - The Sales Tax Rate for South St.

Allstate Peterbilt of South St. Free Unlimited Searches Try Now. For more information on authorized local sales taxes also see the House Research publication Local Sales Taxes in Minnesota August 2010.

Questions answered every 9 seconds. 010 - 050 New Employers. 1815 Marie Ave South Saint Paul MN is a multi family home that contains 3200 sq ft and was built in 1965.

The Rent Zestimate for this home is 2870mo which has decreased by 182mo in the last 30 days. When a vehicle is acquired for nominal or no monetary consideration tax to be paid is based on the average value of similar vehicles. The table below compares South Saint Paul to the other 903 incorporated cities towns and CDPs in Minnesota by rank and percentile using July 1 2021 data.

Duplex Side by Side multi-family built in 1931 with on 012 acres. This is the total of state county and city sales tax rates. The Minnesota sales tax rate is currently.

144 or 834 Employers with Experience Rating. Percent while the rate in the city of St. Paul real estate tax.

Future job growth over the next ten years is predicted to be 367 which is higher than the US average of 335. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The combined rate used in this calculator 7875 is the result of the minnesota state rate 6875 the saint paul tax rate 05 and in some case special rate 05.

Minnesota Income Tax Statistics by County. The location Ranked 1 has the highest value. The st paul park sales tax rate is 0.

823 rows average sales tax with local. 50 40 50 6875 60 55 Sales Tax Rates as of July 2010. This is the total of state county and city sales tax rates.

Contact legislative analyst Pat Dalton at 651-296-7434. Statistics and Annual. Sold in South Saint Paul.

Ad Get Minnesota Tax Rate By Zip. Real property tax on median home. River Heights Chamber of Commerce.

The minimum combined 2022 sales tax rate for South St Paul Minnesota is. Use this calculator to find the general state and local sales tax rate for any location in Minnesota. The Minnesota sales tax rate is currently.

The south st paul sales tax rate is. Sales Tax Rate Calculator. The Zestimate for this house is 444900 which has increased by 12748 in the last 30 days.

The 55106 saint paul minnesota general sales tax rate is 7875. Whether you are already a resident or just considering moving to South St. Paul to live or invest in real estate estimate local property tax rates and learn how real estate tax works.

- The Income Tax Rate for South St. Richfield MN Sales Tax Rate. You can print a 7875 sales tax table here.

The South St Paul sales tax rate is. See reviews photos directions phone numbers and more for Sales Tax Rate locations in South Saint Paul MN. Tax Rates for South St.

Individual Income Tax Statistics. Up to 890. 3 rows The 7125 sales tax rate in South Saint Paul consists of 6875 Minnesota state sales.

The County sales tax rate is. There is no applicable county tax. The county sales tax rate is.

The St Bonifacius sales tax rate is. Discover 216 2ND AVE S SOUTH SAINT PAUL MN 55075 -- Residential property with 2160 sq.

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Minnesota Sales Tax Rates By City County 2022

Dakota County Mn Property Tax Calculator Smartasset

Minnesota Sales And Use Tax Audit Guide

Nebraska Sales Tax Rates By City County 2022

Sales Taxes In The United States Wikiwand

Sales Taxes In The United States Wikiwand

Taxation Of Social Security Benefits Mn House Research

Minnesota Among Highest Ranked States For Tax Fairness Newscut Minnesota Public Radio News

The Most And Least Tax Friendly Us States

Minnesota Among Highest Ranked States For Tax Fairness Newscut Minnesota Public Radio News

State Income Tax Rates Highest Lowest 2021 Changes

Sales Taxes In The United States Wikiwand